The law will send $1,200 checks to many, including Social Security recipients

Federal lawmakers enacted a $2 trillion economic stimulus package Friday that will send most Americans checks of up to $1,200, as a way to put money directly in the pockets of families struggling to manage the economic fallout of the coronavirus pandemic.

The legislation, will give single adults who reported adjusted gross income of $75,000 or less on their 2019 tax returns a one-time check for $1,200, according to draft legislation. Married couples who filed jointly will receive $2,400. Families will get an additional $500 for each child.

In a letter sent to Congress on March 17, AARP asked lawmakers to consider providing checks to Americans as part of any stimulus packages.

“We support direct cash payments to individuals whether working, unable to work, unemployed, or retired,” said AARP Executive Vice President and Chief Advocacy & Engagement Officer Nancy LeaMond in the letter. “Unlike a payroll tax rebate, which helps only those who receive payroll checks, direct payments provide benefits more broadly, including to people most in need.”

Social Security recipients eligible

AARP worked to ensure that individuals who are collecting Social Security benefits for retirement, disability or Supplemental Security Income will be eligible for the stimulus checks, based on their tax returns or Social Security Administration data. AARP successfully fought to guarantee that low-income Social Security recipients will receive the full $1,200 check, not $600 as originally proposed.

If you are receiving Social Security benefits but didn’t file taxes in 2018 or 2019, you will be eligible to receive a stimulus check without a tax return based on data available to the IRS from your annual Social Security benefits statement. The government will send you a direct deposit or check using the information from your Form SSA-1099 Social Security Benefit Statement or your Form RRB-1099 Social Security Equivalent Benefit Statement. You will not have to file a 2019 tax return to get a stimulus check.

The bill does not set a date for when the direct deposits and checks will start to go out, saying only that the Treasury secretary will send the payments “as rapidly as possible.” The money could be sent either by mail or direct deposit.

Who qualifies for a stimulus check?

The size of the check will decrease based on income for individuals who earned more than $75,000 based on their tax return for last year (or their 2018 return if they have not filed yet). The rebate check for individuals will shrink by $5 for every $100 earned over $75,000. For couples who filed jointly, the reduction will start once they earn more than $150,000; for heads of household, at $112,500. This calculator can help you determine how much you might receive in a stimulus check.

Individuals who earned more than $99,000 and couples who earned more than $198,000 jointly will not receive checks.

According to the law, people who do not receive Social Security benefits and also do not typically file taxes because their income is very low will need to file a 2019 tax return in order to receive a stimulus check. That may be a challenge for some, however, because many services that help low-income taxpayers file tax returns for free have suspended in-person operations to deter the spread of the coronavirus. Most low-income taxpayers are eligible to file tax returns online for free through the IRS Free File program.

Editor’s note: This story was originally published on March 26, 2020. It has been updated to include the president signing the bill.

More Stories

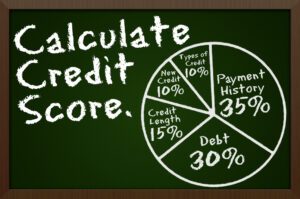

What is a credit score and how is it calculated?

1864 ABORTION LAW ENDANGERS SURVIVORS OF DOMESTIC VIOLENCE

Sex Trafficking

The Super Bowl LVIII

A Difficult Question – Sensible Cremations and Funerals

Twenty Years, Arizona Bilingual News