Your credit score affects many areas of your financial life, from being approved for a credit card to the interest rate you’ll pay on your mortgage.

A credit score is a number that helps lenders like banks, insurance companies, and renters evaluate how well you have handled your financial obligations. It is one of the many factors to take into consideration when establishing a fee for services, for a loan or entering into a business agreement.

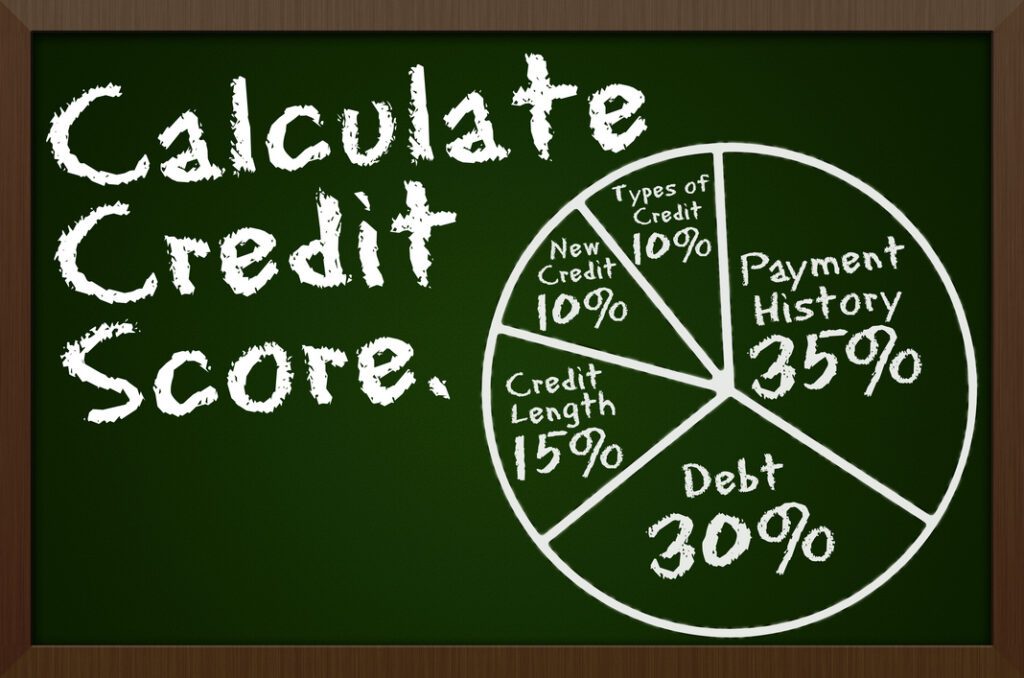

Your credit score is determined from the information in your credit report. There is no single formula to calculate your credit score, but these are the factors that FICO, the leading credit score provider, generally takes into account:

– Payment history (35%). Before lenders give you credit, they want to know if you pay your bills on time. Always make at least the minimum payment before the due date.

– Amounts owed (30%). High balances can hurt your score. Lenders prefer that you use less than 30% of your available credit. You can check the percentage you’re using on your account page on your bank’s website.

– Duration of your credit history (15%). Your score takes into account how long you have been using your credit accounts. Generally, the more time they have the better.

– Types of credit (10%). Having a variety of loan types, such as credit cards, auto or student loans, and mortgages, is good for your score. It shows lenders that you can handle multiple payments at the same time.

– Credit inquiries (10%). Lenders consider you a greater risk if you apply for, or open, several new credit accounts in a short period of time.

If you’re just starting to build credit, the factors used to calculate your credit score may be different than someone else with a longer credit history.

Closing old credit card accounts can hurt your credit score. This is because the calculation considers how long you have had your credit history and your total available credit. Consider using the card occasionally and pay the balance in full.

Credit scores generally range from 300 to 850 and can change monthly.

Banks, loan companies and credit card issuers offer free scores on account statements or through online banking and mobile apps. Under federal law, you are entitled to receive one free credit report annually from each of the three major credit reporting agencies (Equifax, Experian, and TransUnion). Generally, your credit score is not included in the report.

More Stories

Natural Resources, Parks and Recreation launching pool rentals for 2024 swim season

GI Alliance Supports Women’s Health Awareness Month: A Focus on Colorectal Health

The imminent ban of TikTok in the United States

Do you like sleeping with wet hair?

$1M gift helps build equity for UArizona adaptive athletes

Moms in Arizona are in for a Treat!