When you apply for a loan, do you know what information is in your credit report and the method of scoring used by the lender? What is the difference between a credit score and a credit report? Knowing these answers could potentially save you significant amounts over the life of a loan.

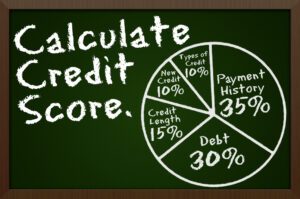

First, let’s look at credit scoring. Not all institutions use the same scoring system, however the most common scoring system is FICO (developed by Fair Isaac Corporation). The FICO score is based on your credit report and ranges from a low score of 300 to the highest at 850. Institutions also set varying minimum scores.

Under the Fair and Accurate Credit Transactions Act of 2003 (FACTA), mortgage lenders are required to tell you the credit scores they used in the process of providing the mortgage. Perhaps even more important, is to talk with your mortgage lender before you are ready to apply for a mortgage to determine what you can do to meet not only the minimum score, but what you can do to earn a higher score. Higher scores may help you to obtain more favorable interest rates and/or lower or eliminate mortgage insurance costs.

Secondly, as noted your score is based on your credit report. You are entitled to a free credit report every 12 months from each of the three major credit bureaus: Experian, TransUnion, and Equifax. Visit www.annualcreditreport.com for more information on obtaining your free report. You should check your reports for any inaccuracies, fraud or identity theft. You will see information from each creditor, with account number, the opening date, balances, loan terms, your payment history and the current status of the account. Because credit bureaus collect information from courthouse records, you may find notes regarding bankruptcies, tax liens, judgments, or even criminal proceedings in your file.

What all this information means in terms of your creditworthiness depends on the lender’s criteria. Generally speaking, a lender feels safer assuming that you can be trusted to make timely monthly payments against your debts in the future if you have been timely in the past. Based on your track record, you could be turned down for credit or given credit at a higher interest rate if you are a poor risk. The steps to get good credit or to repair bad credit are hard work but it is worth it for long-term savings. Talk with your financial advisor about steps you can take to build good credit.

Waddell & Reed is not affiliated with any of the organizations or the website referenced herein. This article is meant to be general in nature and should not be construed as financial advice related to your personal situation. Waddell & Reed does not provide legal or tax advice. Please consult a professional prior to making financial decisions. Investing involves risk and the potential to lose principal.

Kim Fernández is a Financial Advisor with Waddell & Reed and can be reached at 520.745.3090 x116 or by email at kfernandez@wradvisors.com for assistance. Waddell & Reed, Inc. Member SIPC

More Stories

What is a credit score and how is it calculated?

A Difficult Question – Sensible Cremations and Funerals

The Benefits of Banking with a Credit Union

Tips to use a credit card correctly

How likely is it to win the lottery jackpot?

Learn about how to start a small business with the City of Tucson.