Credit cards, used correctly, are a great tool for your personal finances. Although you have to be careful since they can be very dangerous when used in the wrong way.

Tip #1

Choose the credit card that suits you best. There is no one card that is better than the others in every way, which means that the best card will depend on what features are most important to you and your lifestyle. Some of the things that you will have to analyze and determine their importance are: annuity, benefits, interest rate, and commissions.

Tip #2

The first thing you should do once you receive your credit card is informed yourself about the important dates of it. Find out what they mean (we’ll explain it to you below) and what day these important dates fall on.

The cut-off date is the day on which the bank counts the charges you generated during the period (one month). Your account statement will arrive a few days after this date, and it will tell you how much you owe to the bank, and it will give you a list of the expenses and payments you made during the month.

The payment deadline is the most important of your credit card. This is the deadline you will have to pay the balance that has been generated in the previous month.

Tip #3

It is very important to only spend what you can afford on your payment date. It is common and normal for people to feel a great temptation to acquire more and better things. A useful way to figure out if something is worth buying is by looking at its opportunity cost, by comparing it to something else you could buy with that money.

Tip #4

Get out of your debt as soon as possible. Determine your monthly payment capacity

Make a budget in which you include all your fixed expenses and basic needs that you must cover each month (including expenses such as food, housing, education, etc.).

After you are very clear about the exact amount you need to cover your basic needs each month, subtract this amount from your monthly income to calculate how much money you can put towards paying your debts each month.

While doing this step, it can be very helpful to identify what additional expenses you have been spending your money on, which ones you can eliminate and/or decrease so that you can spend more money paying off your debts.

More Stories

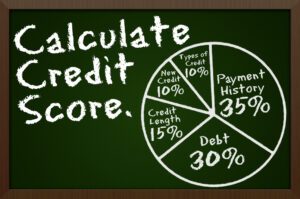

What is a credit score and how is it calculated?

Adopting vegetarian or vegan diets

We all dream of having a pet that is part of our family

April 22, International Mother Earth Day

We have two years to save the planet, warns the UN

The Tucson Roadrunners have announced dates for their 2024 WhiteOut Tour leading up to the Road to the Calder Cup