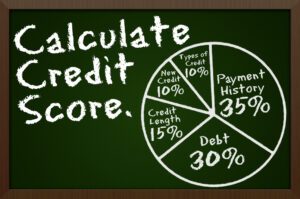

Retirement Planning – what does it mean? It means taking control of your financial future. The sooner you start, the more time you will have to work toward accumulating what you may need to save, plus make adjustments along the way.

How much will you need in retirement? This varies, but you can get a good idea by first thinking about your present living needs. Make a list of your current income and expenses. Next, think about what may change in retirement. Will you move to somewhere that costs less? Will your mortgage be paid off? Are there work-related expenses that you will no longer need to pay, such as gas for work travel?

Next, think about what expenses will continue into retirement. Don’t forget that you will still have to pay income and property taxes, insurance for home, auto and healthcare (Medicare may not cover everything*). Do you plan to spend more for travel, hobbies or taking care of family?

Now think about what income you may have in retirement. Income may come from Social Security* or a pension, or the sale of a business or real estate.

Finally, subtract your anticipated income from your expenses and you will find the amount that you may need to save to provide for a comfortable retirement. Keep in mind, however, that this figure is based on today’s dollars. It doesn’t take into account inflation, and what items may cost more in the future.

How can I save for retirement? If you have access to an employer-sponsored retirement plan, try to contribute as much as you are able. In addition, you may also be able to save through other avenues.

The closer you get to retirement, the more planning you may need and it may help to talk with a Financial Advisor about completing a comprehensive financial plan.

*You can get an estimate of your Social Security by visiting your local Social Security office or going to the website at www.SocialSecurity.gov. You may also learn more about the benefits of Medicare at www.Medicare.gov.

This article is meant to be general in nature and should not be construed as financial advice related to your personal situation. Waddell & Reed does not provide legal or tax advice. Please consult a professional prior to making financial decisions. Investing involves risk and the potential to lose principal. Systematic investment plans do not ensure a profit nor guarantee against a loss in declining markets.

Kim Fernández is a Financial Advisor with Waddell & Reed and can be reached at 520.745.3090 x116 or by email at kfernandez@wradvisors.com for assistance. Waddell & Reed, Inc. Member SIPC

More Stories

PIMA COUNTY HOSTS FEMA HIGH-CAPACITY COVID TESTING CENTER AT PCC WEST CAMPUS

Editor letter

This past month of April, The U.S. Census Bureau released congressional apportionment and population counts for every state.

Tucson City court closed this Friday and, on the holidays

Pima County opens another round of PPE Business Assistance

Sunnyside Foundation provides resources to enhance and accelerate the educational