He’s a Democrat now but also a former Reagan Republican who lived through the modification of the tax deduction changes of the 1980’s. As a retired business man in his 70’s, he scoffed at the idea that Congress could take action that would serve individuals while also while also reducing taxes on corporate America.

I argued that we face a one-in-a-generation chance to conduct tax reform. If we do it right, it could be one of the single most important steps to driving economic growth for our country. As a chamber President, I work daily with businesses from all industries who could gain from significant tax reform. Simplifying and clarifying our tax system for businesses would go a long way in stimulating investment and new hires in our country. Similarly, American workforce and future workers could better understand and plan with a simplified, equitable tax system.

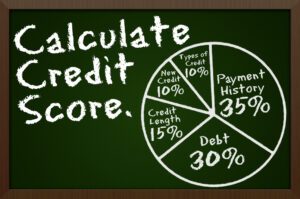

I asked my father to consider the size of the current tax code and indicated with my hands that the “code” printed out would stand almost one foot tall. “Doing your taxes” on your own was impossible today and even the middle class and working class needed to hire an accountant or use a software program to decipher their income taxes. The simplification and overhaul of our tax code would go along way in enabling American companies to compete globally while providing clarity to American’s workers.

My father acknowledged that successful tax reform would likely initiate a cash inflow from companies and investment from abroad. He’d read the stories over the last three decades of companies moving their assets and funds to other countries due to our nation’s corporate income tax rate. Now key players in Congress are working on comprehensive reform that would lower the tax rates for all U.S businesses while adopting an internationally competitive system that would not tax them twice on their overseas earnings. This would make U.S businesses globally competitive and provide a disincentive to move their businesses overseas. I also explained that many businesses – large and small – were supportive of immediate depreciation on their business investments, another key component of comprehensive tax reform. This would also stimulate the economy as businesses reinvested in their machinery and equipment.

The process of overhauling our tax code is complicated and controversial. However, failure to provide significant reform could weaken our economy and make U.S firms less competitive globally. The Tax Cuts and Jobs Act which passed the House last week will reduce the tax rate on the hard-earned business income to the lowest tax rate on small business income since World War II. Our nation is slowly recovering from the recent economic recession. Our businesses need permanency and clarity in our tax code, not the mountain of paperwork and loopholes in the tax system now that are hard to decipher.

My father and I will continue our debate as Congress works through the details, but I am optimistic that the work being done by Congress on tax reform will provide the needed relief for individuals while also serving the needs of our small businesses in Arizona.

Lea Marquez Peterson is the President/CEO of the Tucson Hispanic Chamber and is a Public Voices Fellow.

More Stories

Immigration and Street Releases

PACC at 142% capacity for dogs, in desperate need of adopters and fosters

A Difficult Question

Ready, Set, Rec

A Difficult Question – Sensible Cremations and Funerals

Proud Parents – Anna and Ben