The air conditioner may still be blowing, but it’s not too early to think about Christmas. After all, trees are already up inside a number of stores, twinkling somewhere between displays for Halloween decorations and Thanksgiving tableware. Troubling as they are to some folks who lament the early arrival of upcoming holidays, the decorations signal that a healthy dose of spending is just around the corner.

The National Retail Federation reports that the 2015 holiday shopping season grew by 3 percent to $626.1 billion, while Gallup reports that the average American planned to spend about $830 on gifts last year. Of course, not everyone enjoys or can afford a holiday hangover due to excessive spending at the end of the year.

To avoid buyer’s remorse come January, it makes sense to start saving now. With a little planning and a dash of discipline, it’s entirely possible to begin the new year with a healthy balance of savings, debt and spending.

Set a budget. Every spending plan should come with a budget, otherwise it’s not really a plan. It’s just a hopeful guess. Draw up a list of who you will be shopping for, and attach a budget number to each person. Move past the guilt because the list is just for you. Also, the list isn’t written in stone. It can be adjusted as you go along.

Open an account. Set up a separate savings account linked to your checking account and reserve it for holiday savings. It’s easy to do and it will help you keep tabs on your progress. Depending on when you start saving, count the number of weeks until the holidays, and divide your budget by that number to determine how much money you should be saving each week to reach your goal. And then, stick to it.

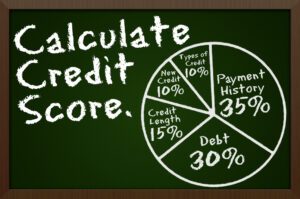

Use credit cards responsibly. Credit cards allow you to take advantage of holiday season sale prices while earning rewards points and enjoying a little flextime between purchases and payment due date. When using credit cards, be sure to do so responsibly. It is a good idea to set up spending alerts to remind you when you’ve hit your spending threshold. This way, you don’t get caught up in the season, only to realize you’ve blown your budget.

More Stories

PIMA COUNTY HOSTS FEMA HIGH-CAPACITY COVID TESTING CENTER AT PCC WEST CAMPUS

Editor letter

This past month of April, The U.S. Census Bureau released congressional apportionment and population counts for every state.

Tucson City court closed this Friday and, on the holidays

Pima County opens another round of PPE Business Assistance

Sunnyside Foundation provides resources to enhance and accelerate the educational