The U.S. government expects 3.3 million high school students to graduate this year. That makes 3.3 million new “adults” who will be charged with navigating financial waters for which they may not be prepared. After all, real life finances are more complicated than saving for a dinner and movie date.

Before young adults haphazardly step on financial landmines such as revolving debt and overspending, it would behoove parents of graduates to offer their kids a real life primer that will better prepare them to act as a responsible consumer. And, the timing is good. Those same kids who are graduating high school will very likely be receiving monetary graduation gifts which should to be invested or saved, but could get spent.

Here are a few helpful tips from Vantage West Credit Union that should be included in any conversation with a graduate about finances.

Pay yourself first. This does not translate to “go shopping, eat out, blow your paycheck.” It means, take a piece of each paycheck and sock it away, for you. You earned your money. Keep some of it. Mentally, it also reinforces where you rank on your financial totem pole: at the top.

Track spending. Sometimes it feels like money just slips away. One minute you have it, the next you don’t. To keep tabs on where your cash is going, track it. Use a notebook, tally receipts or find an app that helps with spending. Tracking allows consumers to identify harmful patterns and correct them.

Establish and follow a budget. Knowing what you have to work with every month is critical. Rather than viewing a budget as a punitive restriction, consider it a map. It sets a course for your finances and keeps you on track.

Bow down to compound interest. Harnessing the power of compound interest when it comes to saving is clutch for young adults. By saving money in an interest-earning account, young adults – any consumers, really – earn interest on top of interest. Compound interest defines the cliché “make your money work for you.”

Respect emergencies. Things happen. Cars break down, toilets leak and refrigerators conk out. Experts recommend creating an emergency fund of about $1,000 to start. It’s better to be safe than sorry.

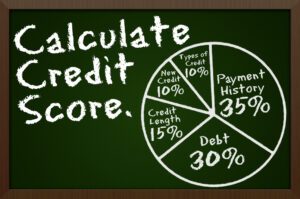

Use credit wisely. It’s true that establishing credit is beneficial, for a variety of reasons. But, credit is a slippery slope. Choose credit cards wisely for their interest rates and rewards, and commit to paying off the full balance each month to avoid paying interest on purchases.

Avoid fees. Fees are such a drag. No one wants to pay fees, and smart consumers avoid them altogether. Keep more money in your account by working hard to avoid late fees, ATM fees, interest fees and checking fees.

Prepare for retirement. Yes, this suggestion may get pooh-poohed by a fresh high school graduate, but it shouldn’t. Talk up the potential. If a young adult starts to save for retirement soon enough, he or she could be sitting pretty by the time they leave the workforce. Experts believe Roth IRAs are the best retirement vehicles for young people.

About Vantage West Credit Union

Vantage West Credit Union is a $1.5 billion financial institution in Arizona, which serves a growing membership of nearly 135,000. Vantage West has branches in Pima, Pinal, Maricopa and Cochise counties and serves its vast membership via online channels, as well. Vantage West is a full service financial institution, offering consumer and business loans, credit cards, and deposit products, as well as retirement accounts and other financial services.

Some products and services are subject to approval. Certain restrictions may apply. Vantage West is federally insured by NCUA.www.vantagewest.org

More Stories

PIMA COUNTY HOSTS FEMA HIGH-CAPACITY COVID TESTING CENTER AT PCC WEST CAMPUS

Editor letter

This past month of April, The U.S. Census Bureau released congressional apportionment and population counts for every state.

Tucson City court closed this Friday and, on the holidays

Pima County opens another round of PPE Business Assistance

Sunnyside Foundation provides resources to enhance and accelerate the educational