2014 tax return must be filed

to keep health insurance tax credits in 2016

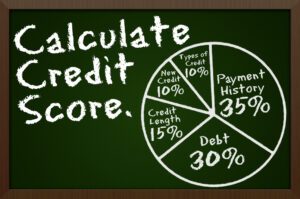

Consumers who received Advance Premium Tax Credits (APTC) in 2014 through the Health Insurance Marketplace and did not file 2014 taxes will lose the opportunity to continue receiving tax credits when they renew their coverage for 2016, unless a tax return is filed in advance of the renewal. Loss of Premium Tax Credits may make health insurance unaffordable for some consumers, including those who are automatically re-enrolled with their insurance providers. Consumers who received APTC and have not yet filed 2014 taxes must act soon, as Open Enrollment begins November 1, 2015.

Consumers who used APTC to lower their monthly premiums in 2014 must file a federal income tax return, even if their household income does not meet the filing threshold. Free tax preparation services are still available throughout Southern Arizona for those consumers who have not yet filed a required tax return.

Local Assistors (Navigators and Certified Application Counselors) can help consumers obtain Form 1095-A – a required tax document for Marketplace enrollees – and enroll in health care through the Marketplace during Open Enrollment. To find a local Assistor call the Southern Arizona Cares Line at 800-377-3536 Monday through Friday, 8 a.m.-5 p.m. Callers should leave a message and their call will be returned within 24 hours.

More Stories

PIMA COUNTY HOSTS FEMA HIGH-CAPACITY COVID TESTING CENTER AT PCC WEST CAMPUS

Editor letter

This past month of April, The U.S. Census Bureau released congressional apportionment and population counts for every state.

Tucson City court closed this Friday and, on the holidays

Pima County opens another round of PPE Business Assistance

Sunnyside Foundation provides resources to enhance and accelerate the educational