Feliz Año Nuevo. What is the best thing you can do to get your finances on track for the New Year? Why, create and stick to a budget, of course. “Oh no, not a budget,” you might say, but here are a few tips that can help.

Feliz Año Nuevo. What is the best thing you can do to get your finances on track for the New Year? Why, create and stick to a budget, of course. “Oh no, not a budget,” you might say, but here are a few tips that can help.

Change your mind set. Think of it as a “Spending Plan” for what you want in life. The number one priority of the plan is to pay yourself first so you can pursue your financial goals. Here’s an example of how it works:

Your paycheck should be deposited into savings, not into the spending (checking) account(s).

Pay bills online, when possible, to save on checks and postage.

Allocate remaining funds to the persons responsible for paying for certain items. For example: Raul gets a haircut and Dona buys the children’s clothes; thus, allocate the dollars for the haircut to Raul’s checking account and the dollars for the children’s clothes to Dona’s checking account. Do this for other personal spending, as well. Remember, just because you have allocated funds to your spending account, does not mean you must spend them all…you can roll excess funds over to savings so they have the opportunity to grow.

Grocery shopping is trickier because the stores entice you to buy more. First rule, never shop without a list! Consider generic brands when possible. You may want to consider putting your grocery money in an envelope and leaving your cards and checks at home.

Dining out is another budget challenge. A greater challenge, however, is breaking the habit of dining out. Try making it a rule to only go out on the weekend or to pack your lunch every day except Wednesdays, for example. Dining out less often can make it more special when you do go out.

Purchasing gas is a good use of a reward card, designated specifically for fuel and vehicle maintenance. You must commit to pay off the balance each month.

So, this leads us back to “paying yourself first”. By following your spending plan, you will begin to see the funds in your savings grow. Now for your spending goals:

Once the funds in your savings reach the amount you feel comfortable with having as an emergency fund (typically 3 to 6 months of expenses), it will allow you to pay cash for things as they come up – and things will come up. Being prepared means you will not have to go into debt.

Once you have your cash cushion, now you can roll those extra dollars into your financial future goals, whether they are for a house down-payment, children’s college, vacation or retirement; that’s “spending” on your future!

Changing your old spending habits can take time, but it does get easier. Staying on a spending plan can work!

This article is meant to be general in nature and should not be construed as financial advice related to your personal situation. Waddell & Reed does not provide legal or tax advice. Please consult a professional prior to making financial decisions.

Kim Fernández is a Financial Advisor with Waddell & Reed and can be reached at 520.745.3090 x116 or by email at kfernandez@wradvisors.com for assistance. Waddell & Reed, Inc. Member SIPC

More Stories

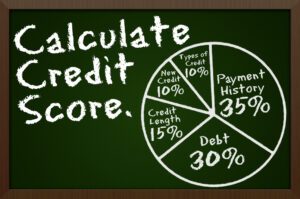

What is a credit score and how is it calculated?

A Difficult Question – Sensible Cremations and Funerals

The Benefits of Banking with a Credit Union

Tips to use a credit card correctly

How likely is it to win the lottery jackpot?

Learn about how to start a small business with the City of Tucson.